.jpg) Here is the summary for month of Mar 10:

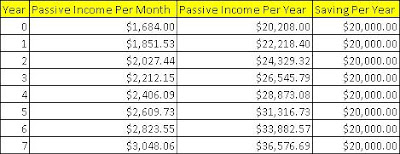

Here is the summary for month of Mar 10:CPF(OA): $156 (from interest and dividends)

Cash: $1724 (from dividends and other passive incomes)

Total: $1880

Target: $3000

Achievement: 62%

There are no changes in my passive income 1 and 2.

For passive income 3, there is an increase as I have bought the following dividend shares: Cambridge and Singtel.

For passive income 4, there is increase of $40. However since it is still in the building stage, I will be expecting it to go up and down. In my post "Forget about achieving Financial Freedom if you do not have perseverance or refuse to learn.", I have mentioned that it will take time and effort to build up passive income.

I am in the midst of building my passive income 5, currently there is no income from it yet.