What is hedging?

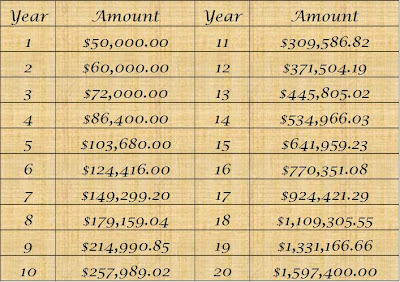

What is hedging?Give you an example. Let say you have two item 'A' and 'B'. When item 'A' price goes down, item B price will go up at the same rate. At any time if you add up 'A' + 'B', the value will always be the same. Please note that hedging is not about increasing the value. It is use to maintain the same value at any time. Let say you have 'A' amount of money, the first thing to do is to spend half of the 'A' amount to buy item B.

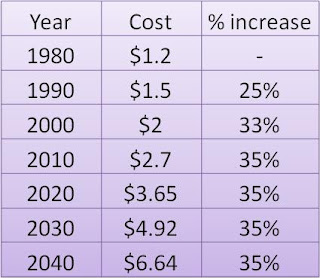

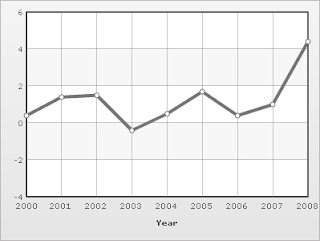

So what can be item B. There are a few investment tools which can use as item B. One of them is to buy gold. I am agreeable with our senior citizens who insist to keep gold instead of money. They somehow have the knowledge of preserving the value of their money. See the graph above, gold keep going up.

Why gold keep going up?

The total amount of gold is a constant. You can never create gold, but you can print money. In the current financial system, where money is printing without stopping, naturally the price of gold will go up.

You may read the following related posts on gold by click the links below:

GOLD VS SGD Chart. Why Gold might be a good investment?

How to buy gold for hedging purposes?

.jpg)