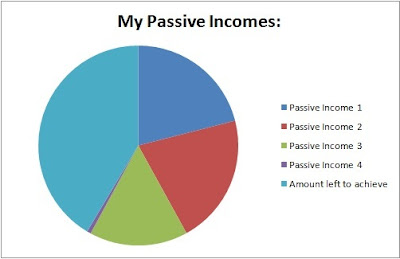

My passive incomes:

The above table shows the total for each of my passive incomes collected from Jan 12 to Dec 12. For my passive incomes, I have managed to collect a total of $20225 for the whole year, which is about $1685 per month. If include the realised gain from selling some of my shares, the total extra incomes for this year will be $23345, which is about $1945 per month. Please note that I did not include unrealised profit of $7400 from shares in the table.

My Monthly Expenses:

My debt:

As for my only outstanding debt from my housing loan, it has reduced from $14000 to $0.

Conclusion:

This year is quite a fruitful year for me though I did not able to achieve one of my New Year resolutions of having a passive income of $2200 by end of 2012. I give myself a "B+" grade for this year performance.

.jpg)

.jpg)

.jpg)