As stated in my post "

My Quotes/Rules of Investment", my first rule is never predict the market direction and my second rule is don't forget the first rule. I have been following these two rules since Oct 09. In my opinion, market direction can never be predicted. Why do I say so?

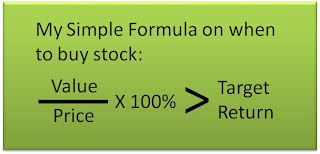

In mathematics, you might see this simple formula,

y = x + 1. So if you know what is x, you can easily know the value of y, the formula is very easy.

Let us see another formula,

y = x + z + 1. Again you must know what is x and z, then you can calculate the value of y. The formula is a bit complicated but still managable.

How about this formula,

y = a + b + c + d + e + 1. There are total of 5 variables and you need to find out all the variables before you can calculate the value of y.

Why economics news make a trader hard to predict the market? Let say there are 5 economics news which can affect the market, you must know whether all the 5 news are positive or negative. To find whether y (the market direction) is postive or negative, you will need to sum up a, b, c, d, and e economics news first. But before you are able to calculate based on your formula, the market direction has already affect in the news. So if you try to predict the markets, you are often too late.

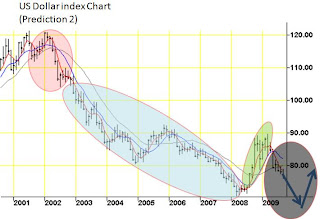

Why Technical Analysis cannot be used to predict the market direction?

I agreed that TA can be used to calculate risk/rewards ratio, but never the direction of the market. If someone were to predict the random market direction accurately, his or her brain will be more complex than the random market direction.

For example let's says the daily share price of a stock is as follow, 1, 2, 2, 3, 3, 4, 5, 5, 4, 3, 5, 6, 7, 8, 9, 8, so what is the next price after 8? You can say is 7, 8, 9 or other number by using TA. That is simply guessing. If you do not know what is the next number in my mind, how do you know what is the next number. The only way you can guess correctly is to read my mind. That will mean that you have powerful six sense or you are a super human being who can control my mind. Even you can read my mind accurately, can you read millions of people mind who trade in the market?

So next time if there is a stock guru tells you that he can predict the market direction, give him a series of ten numbers and ask him to guess whether the next number is higher or lower than the tenth number.

.jpg)

.jpg)

.jpg)