In our lives, we tend to have difficulties like losing our job, having financial problem or having serious illnesses. It will be hard for us to face or cope with these difficulties alone and the best support we can get is from our own family. A family is like a shield that prevents you from being hurt too much from your difficulties. And the only way to make the shield stronger is to build up your family relationships and bonding.

Doing different activities with your family is one way to build up the bonding. It is not necessary to spend a lot of money by going for a family trip in order to build family bond. Some inexpensive activities like spend some times with your children to teach them a skill, or cook a meal or go cycling together with your family are some ways to build up the bonding.

You should not wait till your retirement to start to build family bond as it will be too late. Family bond must be constantly built up as to make it stronger and these will take a lot of time. If you are ignoring your family till your retirement age, you are likely to become a stranger to them and it will very hard to build bond with them.

So if you are finding yourself not spending enough time with your family, now is a time to find out why you are not doing so. Are your work commitment taking away times with your family? Or are you not interested in spending time with your family? Whatever the reasons, you should take some actions and start building up your family relationship.

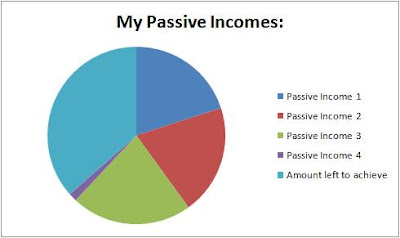

It has been 8 months already ever since I started my journey towards financial freedom. I started with a passive income of $600 on Sep 09 and managed to reach $1905 on May 10. I have plotted a chart to check on my progress as shown above.

It has been 8 months already ever since I started my journey towards financial freedom. I started with a passive income of $600 on Sep 09 and managed to reach $1905 on May 10. I have plotted a chart to check on my progress as shown above..jpg)